The SavTechPay Payroll Management System is a robust software solution designed to revolutionize traditional manual payroll practices by digitizing and streamlining the entire process. Seamlessly integrated with SavTechPay Time Office, this system ensures accurate salary preparation by capturing monthly attendance and work data, thereby moving organizations toward a paperless HR environment.

Key Features of Payroll Software

1. User-Friendly Design and Compatibility

- Designed to work on Windows 10, and Windows 11.

- Built using RDBMS Technology (SQL SERVER) for robust data management.

- Supports multi-user access with defined user-level permissions.

- Minimal data entry requirements make it easy to use and efficient.

2. Support for Complex Organizational Structures

- Supports multiple companies under a single platform.

- Handles various employee types, including:

- On Roll

- Daily

- Hour Basis

- Piece Rate

- Special (user-defined calculation basis)

3. Payroll and Attendance Management

- Imports attendance data from Excel, reducing manual entry time.

- Option to hold salary for specific employees.

- Lock/Unlock salary processing with complete historical tracking.

- Handles adjustments and arrears effectively.

- Bonus calculation with dynamic rule creation.

- Dynamic attendance incentive configuration.

- Simplified master data entry process.

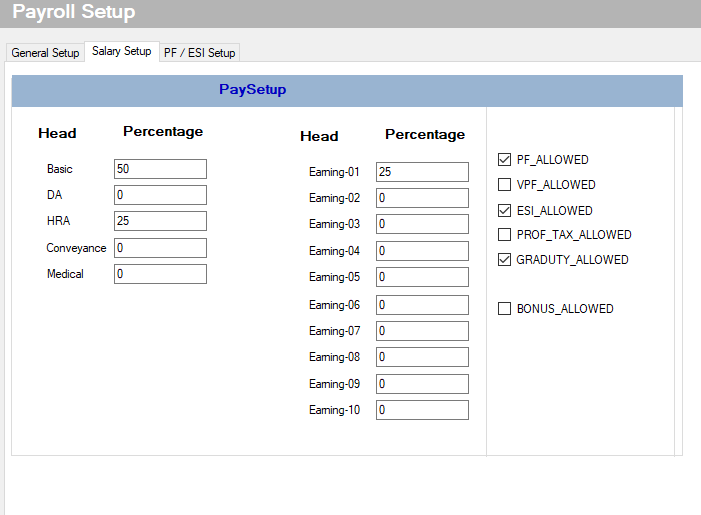

4. Deductions, Allowances, and Taxation

- Comprehensive handling of earnings and deductions, including:

- Basic Pay, DA, HRA, Conveyance

- Loans, Advances, Incentives

- TDS calculation included.

- Flexible payment modes: Cash, Cheque, Bank transfer.

5. Statutory Compliance

- Built-in provisions for PF, ESI, Voluntary PF, and Professional Tax.

- Flexible formula engine for earnings and deduction calculations.

- Supports up to:

- 10 user-defined earnings in addition to standard components.

- 10 user-defined deductions beyond standard PF/ESI.

6. Advanced Administrative Controls

- Company-, department-, and branch-level authorization.

- Monthly arrear and days arrear calculation.

- Automatic deduction of loans and advances from salary.

- Standard statutory calculations: LTA, Bonus, Ex-gratia, etc.

- Full support for Gratuity and Final Settlement procedures.

7. Reporting and Data Handling

- Transaction locking for previously closed months to ensure data integrity.

- Auto-generation of ESI Challan data for ESIC site uploads.

- Over 60 reports, covering areas like:

- PF

- ESI

- Bonus

- Gratuity

- Professional Tax

- Welfare Funds

- Reports are built using Crystal Reports and offer Excel export capability.

Attendance & Payroll Management Software

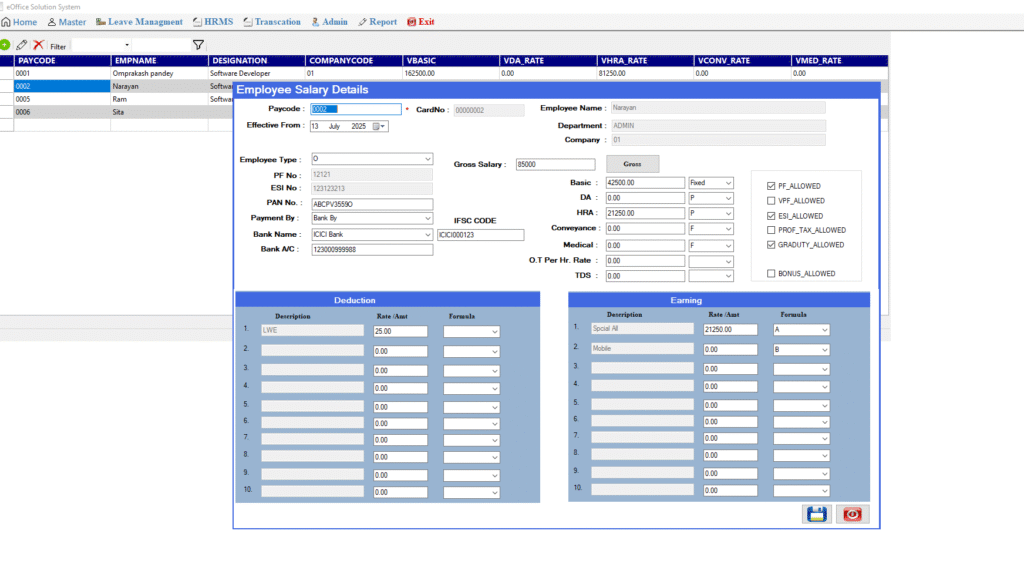

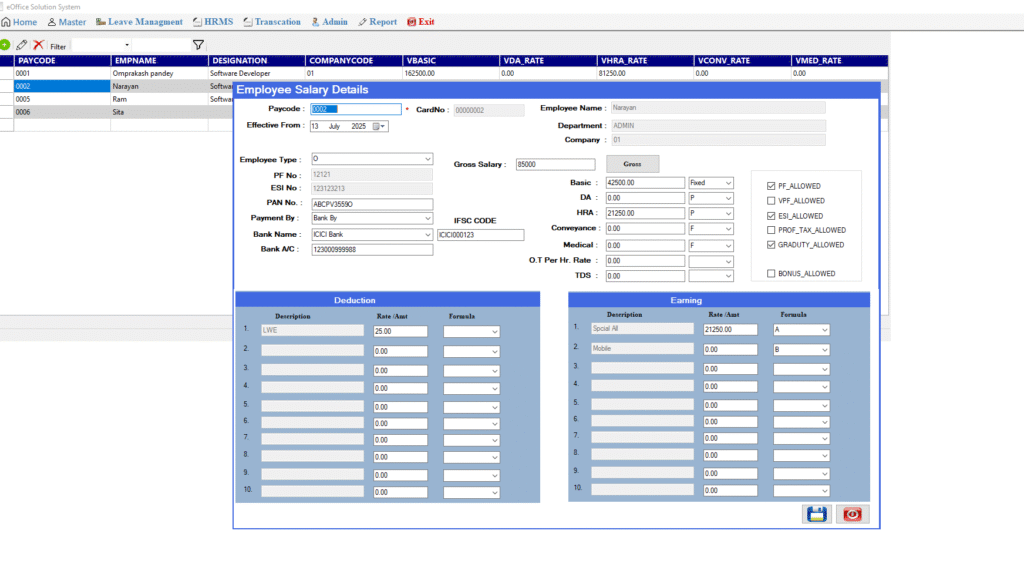

The Payroll Software screen is a well-structured and user-friendly interface designed to manage employee salary, deductions, and earnings with high accuracy and ease. This system is part of a larger HRMS (Human Resource Management System) and supports complete payroll processing and compliance for organizations of all sizes.

Key Sections and Functionalities

1. Employee Selection Panel (Left Side)

- List of Employees: Displays all employees with basic details like Paycode, Name, Designation, Company Code, and Basic Salary.

- Search/Filter Option: Helps quickly locate any employee based on Paycode or Name.

2. Employee Salary Details (Main Form)

This section allows HR or payroll officers to enter and manage salary structure and account information for individual employees.

- Paycode & Card No: Unique identifiers for each employee.

- Effective Date: Indicates when the salary structure becomes active.

- Employee Details: Includes Name, Department, Company, and Employment Type.

- Bank Details: Includes Bank Name, Account Number, IFSC Code, and Payment Mode (e.g., Bank By).

- Statutory Numbers: PF No., ESI No., PAN No.

3. Salary Components

Gross Salary Calculation

- Gross Salary: Auto-calculated or manually entered.

- Salary Breakup: Consists of Basic, DA, HRA, Conveyance, Medical, OT Rate, TDS, etc.

- Types: Fixed, Percentage-based (P), or Formula-driven (F).

Allowances Section

Check boxes for statutory compliance:

- PF Allowed

- VPF Allowed

- ESI Allowed

- Professional Tax

- Gratuity

- Bonus

These selections directly impact monthly deductions and statutory filings.

4. Earnings Section (Right Panel)

A customizable area where additional earning heads like:

- Special Allowance

- Mobile Allowance

- Other Custom Allowances

Each line includes:

- Description

- Amount

- Formula (A/B/C etc.) – Refers to predefined formulas linked to percentage of basic or other heads.

5. Deductions Section (Left Panel)

Just like earnings, deductions are customizable:

- LWE (Leave Without Earning)

- Other deductions like Loan, Advance, Fines, etc.

- Includes Rate/Amount and applicable formula selection.

6. Action Buttons

- Save Icon (Floppy Disk): Saves the salary details.

- Eye Icon: Likely used to preview or review the entered data before saving.

Use Case and Benefits

This payroll screen is ideal for:

- Salary computation for each employee.

- Real-time changes in earnings or deductions.

- Integration with TDS, PF, and ESI compliance.

- Preparation of monthly salary slips and bank statements.

- Custom formulas and flexible configuration options for dynamic salary policies.

Conclusion

This payroll software screen provides a powerful tool for automating employee salary management. It ensures transparency, consistency, and compliance with statutory regulations. With features like formula-based calculations, customizable fields, and direct bank payment support, it greatly reduces manual effort and error, making it a critical component of any modern HRMS solution.